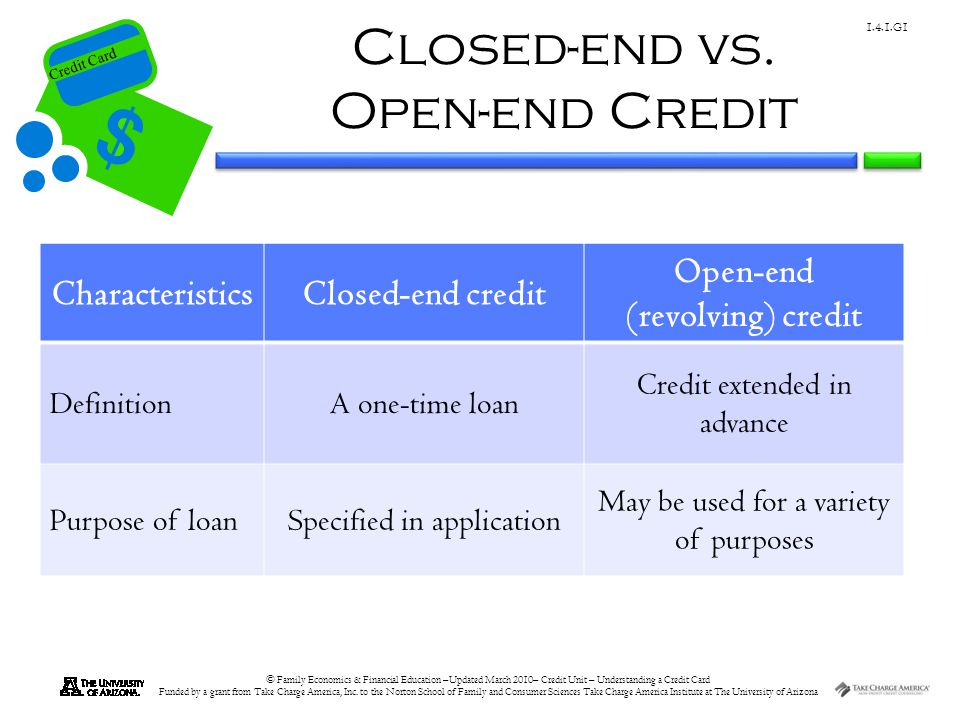

closed end loan vs open end

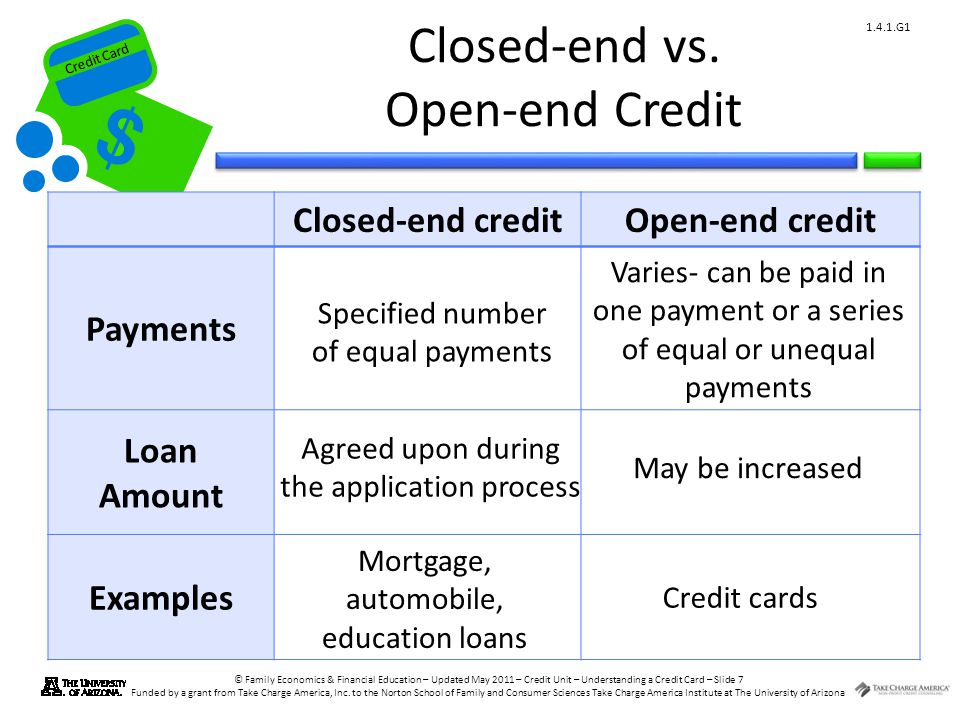

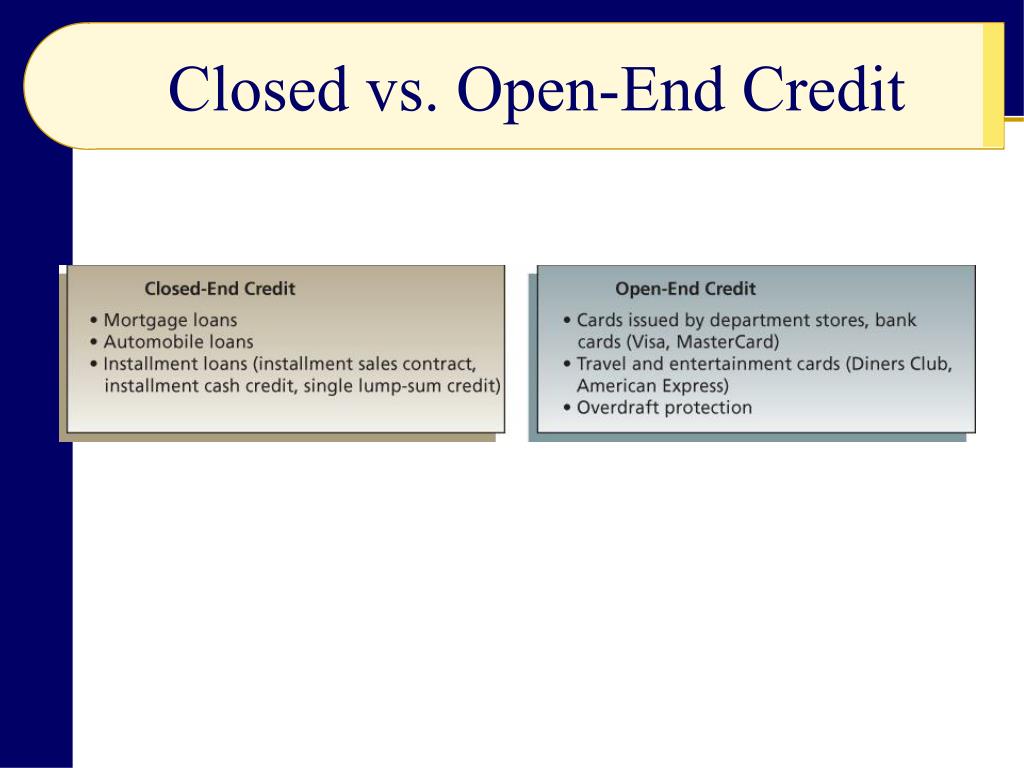

Also the loan terms cannot be modified. A closed-end loan is usually an installment loan in which the loan is granted for a particular sum and repaid in installment payments on a predetermined timetable.

Understanding Different Types Of Credit Check Sort Each Scenario Into The Correct Category Based On Brainly Com

Thats the core difference between these distinct forms of credit.

. Also the loan terms cannot be modified. Fixed rates on closed mortgages will be lower compared to open mortgage rates. Closed-end credit is a type of loan taken out in one lump sum and repaid in full by a specific date while open-end credit is much more flexible and reusable.

An open-end loan is set up. When you lease a car youll usually be offered a closed-end lease. One of the benefits of an open ended line of credit is that the.

Examples of open-ended loans include lines of credit and credit. For example if you. A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment.

Thats the core deviation between these singled-out forms of. An open-end mortgage on the other hand can be repaid early. On an open ended line of credit you only pay interest if a balance is kept at the end of the statement period.

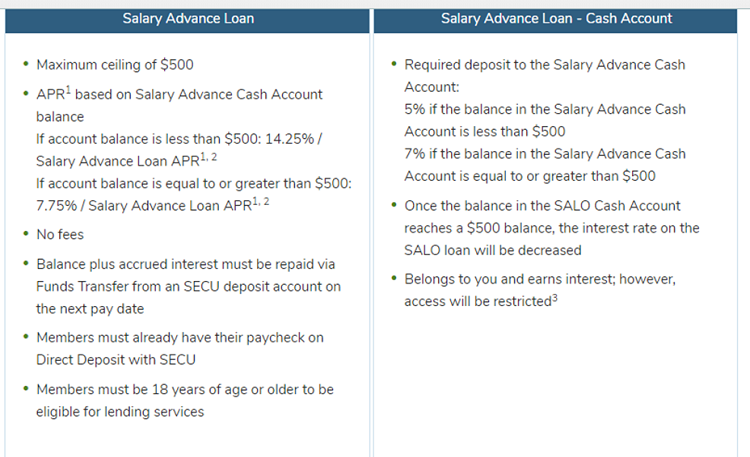

A loan can be closed-end or open-end. A closed-end loan gives the borrower the full loan amount upfront and requires them to pay it back over time in installments. Closed-end loans may come with collateral requirements.

These loans can be secured or unsecured depending on different factors. But closed-end mortgages also typically have lower interest rates because lenders regard them as a lower risk. Explore which type of credit will help.

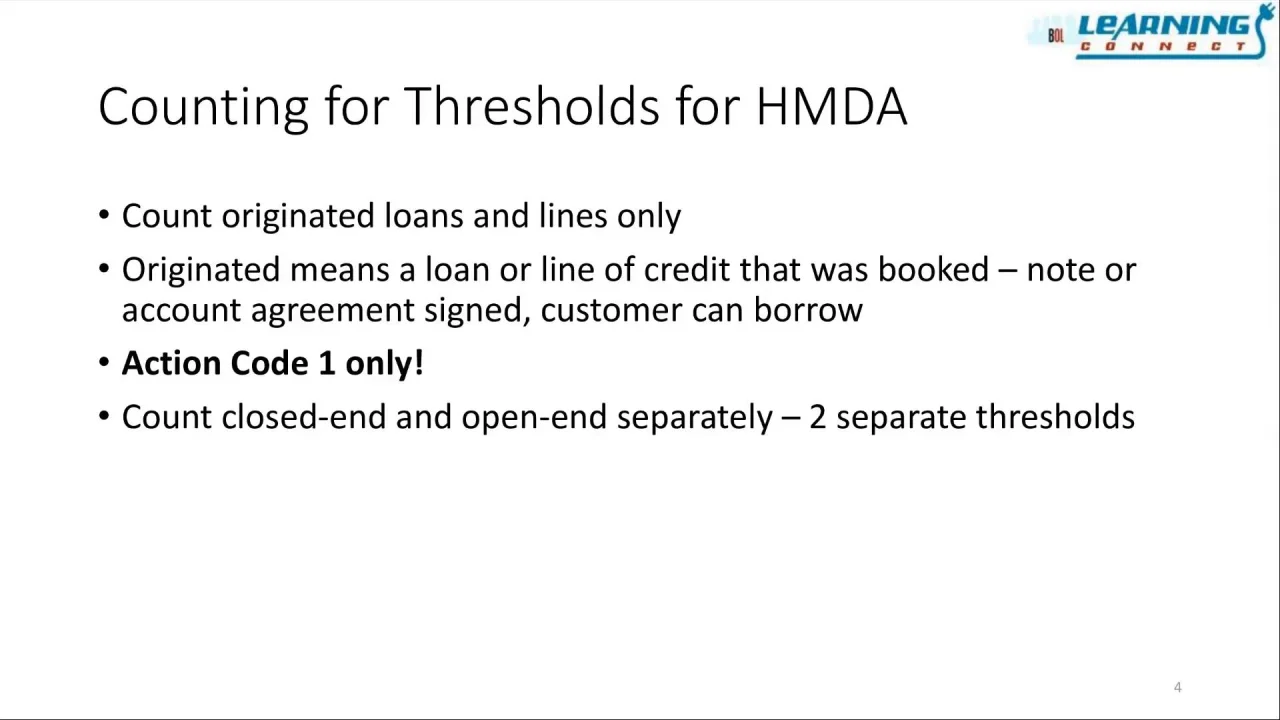

Unlike open-end credit closed-end credit does not revolve or offer available credit. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. What is Open End vs Closed-End Credit.

In other words if you try to make a payment other than. Closed-end loans follow the traditional mortgage structure with all monies given at the loan signing and fixed payments on the loan paid to the lender monthly. Generally speaking closed-end leases tend to be more expensive than open-end leases.

Closed-end leases are more costly because they offer less flexibility for the lessee. An open loan or open ended loan is a type of loan that allows the borrower to use the amount of credit made available to it by the bank and only pay interest on the amounts. An open-ended loan is a loan that does not have a definite end date.

Open-end credit is a revolving credit product while closed-stop credit is a nonrevolving lending product. Open loans dont have any prepayment penalties while closed-end loans do. Open-end or revolving lines of credit.

Open-end credit is a revolving credit product while closed-end credit is a nonrevolving lending product. With an open fixed rate mortgage interest rates will be high because they offer the security of. In a closed-end lease the leasing company takes on the risk of any additional depreciation.

Closed-end credit however prevents the. It remains open and it.

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Solved Open End Lease Open End Credit Closed End Credit Closed End Lease Cliffsnotes

Closed End Credit Vs Open End Credit 5115 Youtube

Open Vs Closed End Leases What To Know Credit Karma

Understanding A Credit Card Ppt Video Online Download

What Is Open End Credit Experian

Ppt Chapter 6 Credit Use And Credit Cards Powerpoint Presentation Free Download Id 5727535

Essential Standard 5 00 Objective Ppt Download

Ever Wonder The Difference Between Open End Leases Vs Closed End Leases International Autosource

Credit Basics Vocab Flashcards Quizlet

Understanding Your Credit Card Ppt Download

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

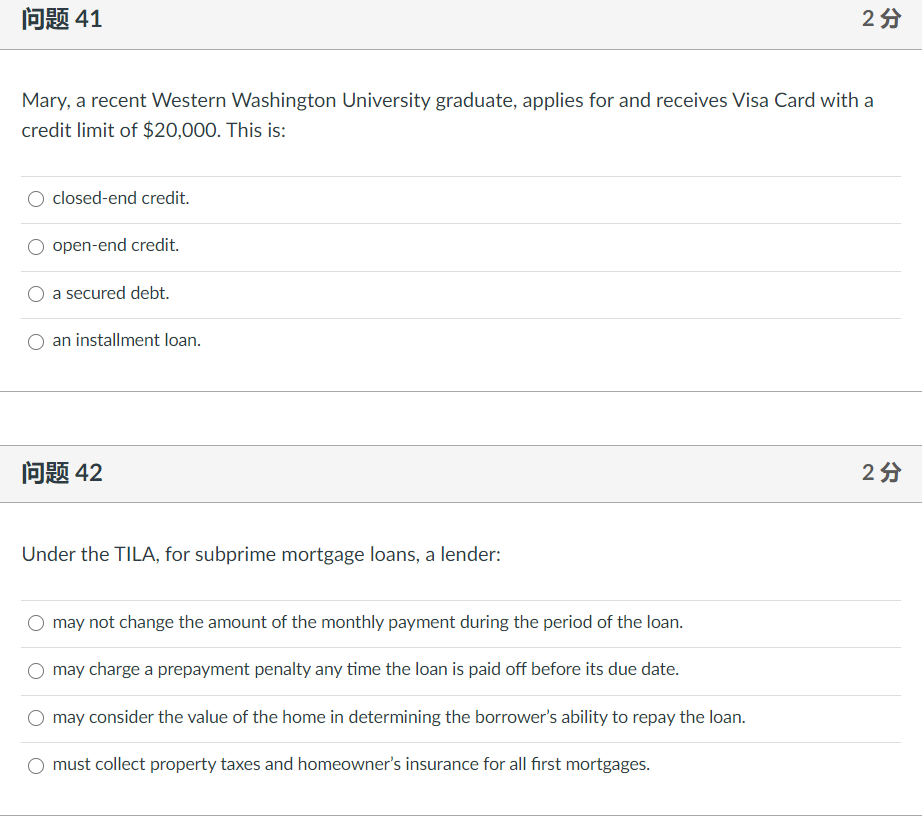

Solved 问题41 25 Mary A Recent Western Washington University Chegg Com

:max_bytes(150000):strip_icc()/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)